The Intergovernmental Panel on Climate Change (IPCC) warns that global temperatures have risen by 1 Degree Celsius above pre-industrial levels, with known consequences of global warming. The IEA has set a 2050 deadline for net-zero emissions, but as of 2023, we are only achieving 60 per cent of what is required. The scientific consensus is that the utilization of fossil fuels is the primary contributor to global warming. Clearly, there is a pressing need to transition to sustainable energy sources due to the current demand for alternatives.

The imperative for energy transition, however, extends beyond climate and encompasses the critical need to ensure energy security and affordability. Recent global energy crises, fueled by geopolitical conflicts, have further heightened policy concerns regarding uninterrupted access and affordable supplies, impacting economies, households, and industries.

The challenges of energy transition

Since the Industrial Revolution, there has been no comparable transformative energy shift. To state that replicating this shift in today’s context is challenging is an understatement. It involves more than just adopting renewables. At a high level, the transition will be a complex process that would need to take into consideration multiple factors. It will require a holistic approach that addresses local and global obstacles through systemic overhauls in infrastructure, policies, technology, distribution, and industries.

The existing energy landscape relies heavily on large-scale extraction of fossil fuels and intricate supply chains for transportation and distribution. Making the shift will involve substantial investments in new technologies and retrofitting existing infrastructure. Furthermore, political and regulatory hurdles, resistance from established players, inadequate supportive policies, and the formidable task of changing mindsets all pose challenges to this transition.

The transition could also have a notable socio-economic impact including greater energy price volatility, with the shift potentially impacting jobs in traditional energy sectors.

Commodities crucial to energy transition

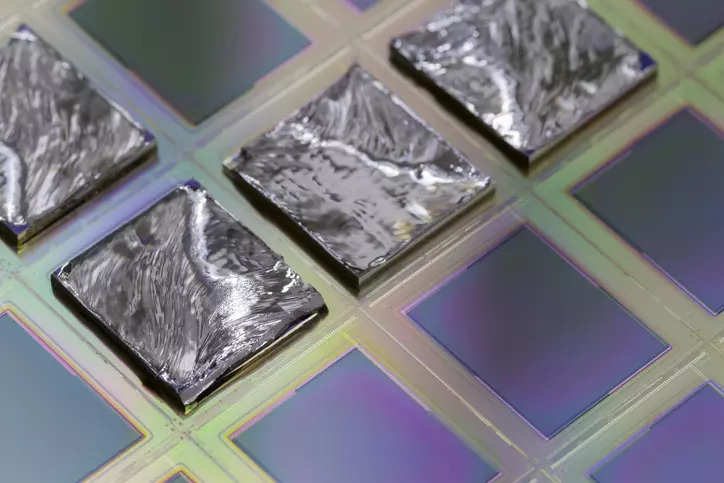

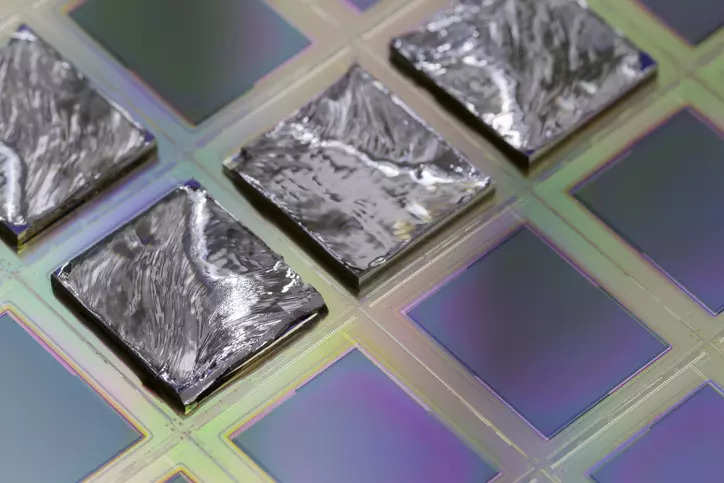

Commodities have played a vital role in driving industrialization, shaping economies, and providing modern comforts through infrastructure development and equipment provision. In the current context, they are also critical inputs in the energy transition, especially for low-carbon fuels and renewable energy. Materials like lithium, cobalt, copper, silver, and rare earth elements are indispensable in manufacturing batteries, wind turbines, and solar panels. A reliable and affordable supply of these materials is essential for achieving a sustainable energy future.

More recently, green hydrogen has emerged as a promising energy carrier for decarbonizing hard-to-electrify sectors like heavy industry and transportation. However, its production and distribution require significant infrastructure investments, creating a crucial role for commodities such as steel and cement in driving the energy transition towards sustainability.

The production and processing of energy transition minerals should not be left out of the equation. These minerals require more energy at every stage of the value chain – including its supply chain that leads to higher emissions intensity. Navigating the opportunities and challenges associated with the interplay between commodities and the energy transition, will require policymakers, investors, and stakeholders need to understand the dynamics at play.

Risk management and future opportunities

Recognizing the pivotal role that commodity markets play in accelerating the adoption of clean energy, it is crucial to master and manage the associated risks. The relationship between commodities and energy transition is intertwined, as traditional energy sources, metals, and agricultural products are vital in energy production and consumption. However, the complex global supply chains for these commodities, often concentrated in a few countries, pose ongoing challenges in implementing effective risk management strategies.

Market volatility, price fluctuations, and supply chain disruptions are among the risks that businesses must navigate in commodity markets. Additionally, the uncertainty surrounding future policies and regulations to support renewable adoption can impact profitability for businesses operating in traditional commodity markets. Moreover, venturing into new markets, such as carbon and Hydrogen, can be complicated for companies with legacy business processes and technology infrastructure that hinders the incorporation of new asset classes.

Adopting a digital and data first approach to optimize trading and supply chain operations will be paramount in keeping up with the changing dynamics of commodity markets, facilitating seamless global movement of energy and commodities, and maintaining competitiveness. This is particularly crucial as the carbon and Hydrogen markets continues to mature and incorporating this new asset classes into existing trading practices may pose challenges due to limitations imposed by legacy technology infrastructure. By leveraging digital technologies, businesses can better equip themselves to make critical business pivots within a timeline that aligns with their energy security objectives.

Digital transformation will be a game-changer in efficiently managing risks associated with commodity markets. Real-time visibility, predictive analytics, and collaborative engagement will empower companies to proactively identify and mitigate risks, while ensuring sustainable and resilient supply chains and fuel infrastructure. A strategic approach driven by digital will promote transparency, compliance, and stakeholder engagement, while making meaningful contributions towards building a greener and more sustainable future for the industry.

Furthermore, a technology-led approach will provide stakeholders with enhanced operational flexibility and agility, enabling them to navigate the perpetual challenges of market volatility more effectively. Digital transformation will also pave the way for a reliable supply of materials that align with the broader goal of achieving a more sustainable future, allowing companies to pursue profits with a purpose.

Key takeaway

The energy transition is being driven not only by the imperative to reduce emissions but also by changing consumer preferences and demand shifts. This requires a comprehensive approach that balances emissions reduction, energy security, and affordability. The journey towards a sustainable future will be influenced by various factors, including government policies, technological advancements, and the ability of legacy industries to transform and reskill their workforce. However, effective risk management is vital, and a digital-first approach will be crucial in enabling businesses to navigate evolving market dynamics while enhancing operational flexibility in pursuit of a sustainable future.

[This piece was written by Animesh Jha, Associate Director, and Mukul Sharma, Senior Director, Energy and Commodities, Publicis Sapient]