Mumbai: JSW Group has joined the race to acquire two coking coal mines from Australia’s BHP Group in a potential $1.5-2 billion deal as the Indian steelmaker looks for resources to fire its blast furnaces, said people in the know.

The Daunia and Faunus mines, with 20 million tonnes per annum (MTPA) capacity, in Queensland are being sold by BHP following a 32 per cent drop in half-year profit, dissatisfaction with the state’s coal royalty hike, along with ESG (environmental, social, governance) concerns. Of the 20 MTPA, 15-16 MTPA is coking coal used for steel making while the rest is thermal coal.

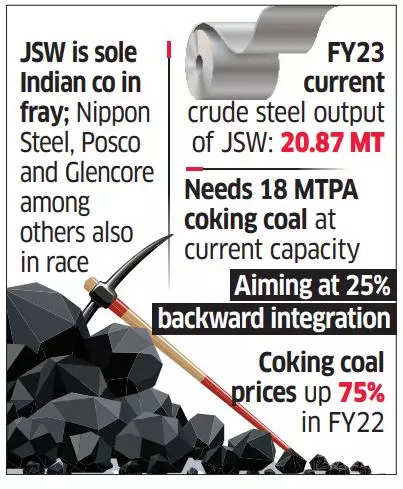

JSW is the only Indian company in the fray and will compete with global firms such as Nippon Steel, Posco and Glencore.

Non-binding Bids Soon

Local mining groups Yancoal and New Hope Corp besides several private equity groups are also in the fray. Non-binding indicative bids are due in the coming weeks.

JSW said it wouldn’t comment on speculation. BHP did not respond to ET’s queries.

Some of the analysts keeping a close watch on developments said JSW may be open to partnering with a PE group as part of a consortium. BHP and its Japanese partner, trading house Mitsubishi, have also decided to sell the Blackwater mines from their BHP Mitsubishi Alliance joint venture in Queensland.

The planned divestment follows BHP’s sale of its 80 per cent stake in BHP Mitsui Coal (BMC) coking and thermal coal joint venture to Australian firm Stanmore in May 2022. The joint venture’s Hay Point port facility near Mackay has a capacity of 55 MTPA although it only exported 46.3 MTPA in 2022.

Maximising Asset Value

“We are seeking to divest these assets to an operator who is more likely to prioritise the necessary investments for continued successful operation,” BHP said after its quarterly results in February. “We will look to maximise the value of these assets via trade sale.”

Steel companies globally are looking to decarbonise by using hydrogen or natural gas as alternative fuels for their blast furnaces. But those efforts will not fully replace coking coal.

“The quality of coking coal has a direct impact on emissions and energy intensity. So usability of the coking coal from Australia will be key,” said an official in the know on condition of anonymity. “High-grade coals will help reduce carbon intensity through more efficient blast furnace operations. So, for players like JSW, who will also have to weigh freight costs from Australia, this will be an important consideration.”

Coking coal prices in Australia have been increasing steadily despite the global recession, particularly after China lifted the unofficial ban on sourcing from the country imposed in 2020. China restarted buying coking coal from Australia in January with a shipment of 1.4 million tonnes of coal loaded on 14 ships.

Jharkhand Coal Mine

JSW Steel has drawn up plans to invest Rs 2,000 crore to develop a virgin coking coal mine in Jharkhand, as per the company’s senior leadership. It was declared the highest bidder for the coking coal mine put up for auction recently and is waiting for an official communication from the government. The company is expecting the new mine, which has reserves of about one billion tonnes, to be operational by FY26. The scale of operations will be similar to its Moitra coking coal mine, also located in Jharkhand.

JSW at its current capacity needs 18 mt of coking coal per annum. To achieve 25 per cent of integration, the company requires about 4.5 mt of captive coking coal but that kind of supply is not available in India. Hence the hunt for global assets. The plan is to blend 20-30 per cent of domestic coal with high-quality coal to lower the overall cost.

The long-term sustainable coking coal price is about $150-170 a tonne. But post-Ukraine volatility in commodity prices has meant trading or upstream miners such as Glencore making $34 billion in net profit. More than half of the windfall earnings came from the sale of coal. Coking coal prices reached $670 per tonne FOB Australia in March 2022, up 75 per cent from the year before, thereby impacting users like JSW.

Over the years, JSW has gained mining experience and currently operates four mines in Odisha, nine in Karnataka, a lignite mine in Rajasthan and a mine each in US and Dubai.