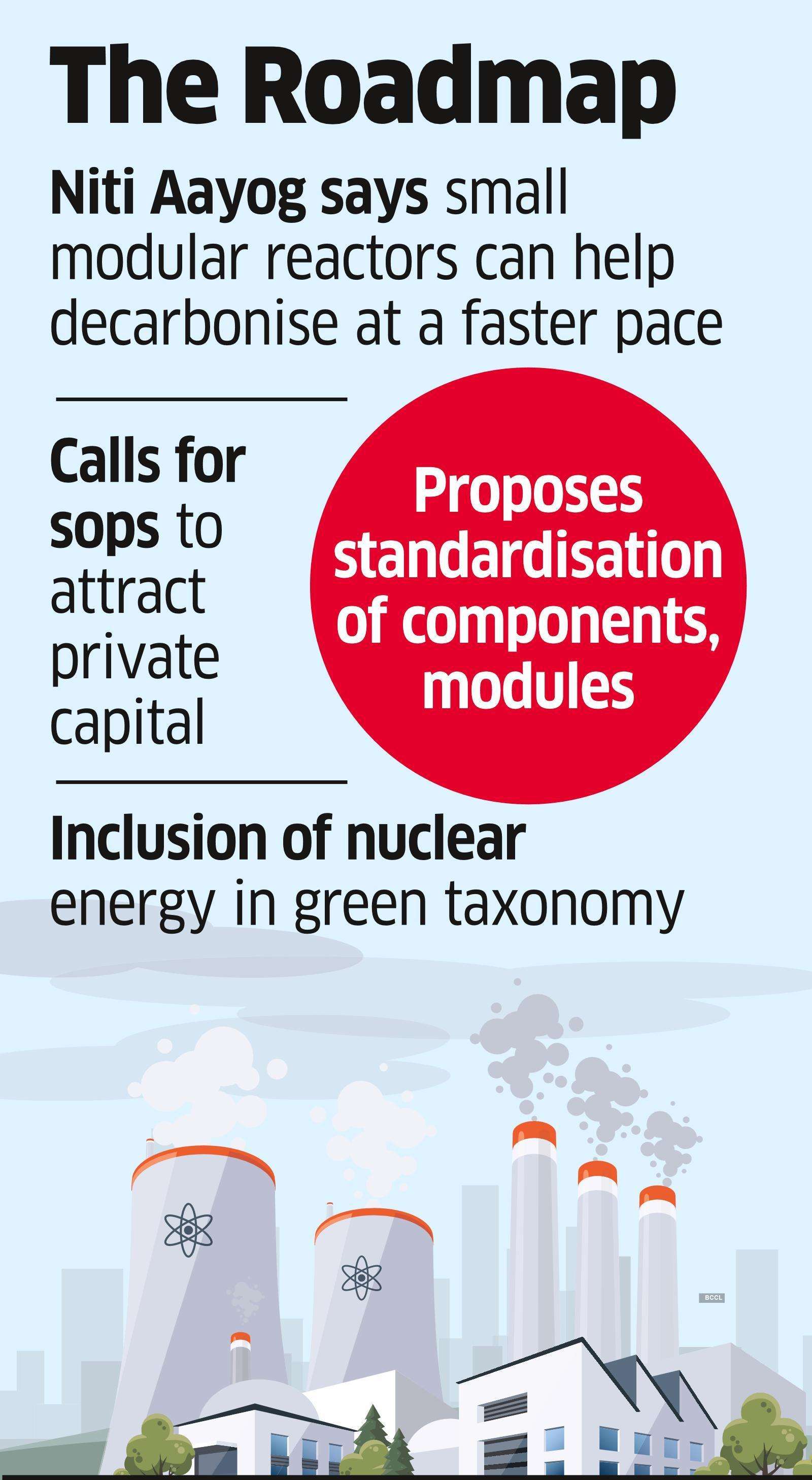

NITI Aayog has proposed blended financing and green bonds to attract private sector investment in setting up small modular reactors (SMR) to generate nuclear energy to help decarbonise energy sector.

The official think tank has also suggested a review of the existing nuclear regulatory framework to make it more comprehensive to accommodate various kinds of SMR technologies and designs, which are at different stages of research and development. These recommendations are part of NITI Aayog’s report on the ‘Role of small modular reactors in energy transition’, jointly prepared with the Department of Atomic Energy.

As per International Atomic Energy Agency (IAEA), SMRs are advanced nuclear reactors with a power generation capacity ranging from less than 30 MWe to 300+ MWe.

According to the Aayog report, SMRs have emerged as preferred nuclear energy options compared to large reactors as they require low inventory of nuclear material per reactor, with speedy fabrication through standardisation, fast realisation along with feasibility of deployment at difficult sites, and phased capital expenditure by adding successive batches of SMR modules.

This, it said, makes SMRs an emerging technology to provide clean electricity, hydrogen and process heat. “SMRs can provide stable baseload electricity and have the capability to operate flexibly to support integration of variable renewable energy into the grid,” it said.

Further, these can also serve nonelectric applications such as desalination and district heating while micro SMRs can be used to supply electricity as well as heat for communities in remote locations.